The Why and How of Getting Compensated for Your Appliance Repair Business

Selling your business is a life-changing decision. If you’re thinking about taking the plunge, it’s crucial to learn more about your options for selling and which factors affect how much your appliance repair business is worth.

Reasons for Selling Your Appliance Repair Business

Small business owners are putting their businesses on the market for a wide range of reasons.

Retirement

The average retirement age is 64 in the U.S. Fixing appliances is a physical job, and you might find that running your business becomes increasingly challenging with age. Crawling around on the floor to do a refrigerator repair or a dishwasher repair can be extremely taxing as you get older.

Selling your business is a great way to get a lump sum of money you can use to retire comfortably. If things are going well, consider an early retirement to take advantage of your business momentum to get a higher sale price.

Personal Reasons

It’s not uncommon for business owners to work 50 hours a week or more. It can be difficult to make time for your family.

Welcoming a new addition to the family or moving for your spouse’s career can be valid reasons to sell your business.

You should also think about selling your business if you’re experiencing burnout or health challenges or find that you’ve lost your drive and passion. New business creation is currently down by about 3%, but there are exciting opportunities to explore in the freight trucking, restaurant and food, hospitality, landscaping, or automotive repair industry.

And with a monthly job growth that exceeds 400,000, there are some interesting opportunities to explore outside of entrepreneurship.

Financial Considerations

Inflation can cut into profits for all home services business – including the appliance repair industry. You need to be able to constantly increase prices to keep up.

Local appliance repair service companies now have to endure the presence of national chains like Lowe’s and Home Depot competing for a limited base of customers who are experiencing appliance issues. Competition from franchises like Mr Appliance also can put stress on home appliance repair companies. All this can make it exceedingly difficult for small businesses to successfully compete in the appliance service market.

Options for Selling Your Appliance Repair Business

If you keep telling yourself, “I want to sell my appliance service business,” it’s time to consider your different exit options.

Internal Selling

With an internal sale, employees or managers purchase your business. It’s a great option if you want to ensure business continuity, and it’s a common solution for family businesses since you can have a child or another relative take over your business.

Internal selling protects your employees’ jobs and preserves the company culture and work ethic you developed over the years.

Besides ensuring a smooth transition, selling your business to key employees shows how much you value their experience and dedication. It’s often the best way to ensure your customers will continue receiving a quality appliance repair service.

Plus, the sales process can be faster since you already have selected a few potential buyers.

There are a few things to keep in mind if you want to sell to an employee:

- Employees don’t have enough cash to buy your business. You’ll have to set up a payment plan and will receive your money over the years as the business generates a profit.

- There are some risks involved. An expert technician doesn’t always turn into an excellent business owner. If the new owner fails to generate a consistent profit, you might not receive payments.

- You’ll have to agree on business valuation with the buyer. Negotiating an appealing price can create a strong incentive for the potential buyer.

- Selling to an employee facilitates the transition and often allows you to stay on board as an advisor.

If you feel that selling your appliance repair service business to your employees is your best option, there are a few different deal structures to discuss with potential buyers:

- You can transfer ownership to a group of employees with an Employee Stock Ownership Plan. Each employee will own a share of the business and participate in making important decisions.

- If your potential buyer has a good credit score and a strong financial situation, discuss the possibility of a leveraged buyout. This method lowers your risks since the buyer borrows from a lender to give you a lump sum of money.

- A long-term installment sale is the most common method for selling a small business to an employee. With this type of deal, the new owner will make monthly payments over the years. There are risks involved, but this method can help supplement your retirement income.

Selling to a Third-Party

Selling your appliance repair company to a third-party buyer can be more challenging, but there are some benefits to consider:

- Selling to a third party gives you access to a larger pool of buyers, which can result in a higher purchase price.

- You will receive a large payment at closing. There are fewer risks since your payout doesn’t depend on how the business performs after the sale.

- The sale process is faster compared to an internal sale. You can also get help from a business broker to facilitate the sale.

The downside of selling to a third-party buyer is that the transition might not be smooth. The new owner might have a drastically different vision of your company. The sale will affect employees, and your customers will notice a difference.

Do you want to sell your commercial appliance service business to a third-party buyer? Here’s what this process typically looks like:

- Start by determining how much your business is worth so you can come up with a fair price.

- Gather all your financial documents for the past five years to help potential buyers get a clear picture of how much you earn.

- Advertise your business for sale via online directories. Your local Chamber of Commerce might have a directory you can use.

- Consider working with a business broker. A broker can help advertise your business for sale and vet potential buyers.

- Learn more about potential buyers. Make sure they are a good fit for the business you’re selling and find out more about their strategy for financing the purchase.

- Once you’ve found a serious buyer, you can negotiate the price and terms of the sale.

What Is the Average Selling Price of a Small Business?

The value of a business is the sum of its assets minus its liabilities. However, this valuation method makes it difficult to account for intangible assets like customer loyalty or the potential for future growth.

As a rule of thumb, buyers typically pay two to three times the annual earnings of a small business before interest, taxes, depreciation, and amortization (EBITDA). Remember that it’sthis is a general rule and that several factors can affect what a buyer is willing to pay for your business.

You’ll need to keep meticulous records of not only your revenue, but each cost that your business incurs. This will include items like your appliance repair business labor costs and appliance repairs cost (including parts), your business insurance cost (to name just a few items).

Given the complexity of business valuation, you would be wise to choose to work with professional business appraisers or accountants who specialize in small business valuations. These experts can provide a more thorough and objective assessment, taking into account industry-specific factors and using sophisticated valuation models.

How Much Can You Expect to Get for Your Appliance Service Business?

You keep telling yourself, “I want to sell my appliance service business,” but how much can you get for your business?

Ultimately, the true value of a business is what a willing buyer would pay for it, but having a well-reasoned estimate can be invaluable for planning purposes.

Let’s take a closer look at the main factors that can influence what your business is worth.

Manner of Payment

Your purchase agreement will state the purchase price and the manner of payment. The buyer might make an initial deposit, pay a lump sum at closing, or make installment payments.

The flexibility of financing the business and making monthly payments can add value for the buyer and justify a higher purchase price.

Physical Assets

The new owner will take possession of the physical assets employees use when they fix a broken appliance.

These assets typically include tools, your appliance parts inventory, company vehicles, computers, office furniture, and more.

The quantity and condition of these physical assets can have a significant impact on the sale price. For instance, a business with a fleet of brand-new vehicles and a large inventory of parts from brands like GE appliances or Whirlpool will be worth more.

Other Assets

Not all assets are physical. Your purchase agreement can outline the transfer of digital assets, such as a portfolio of vetted vendors or a customer list. A customer base with several long-standing accounts will boost the value of your appliance repair business.

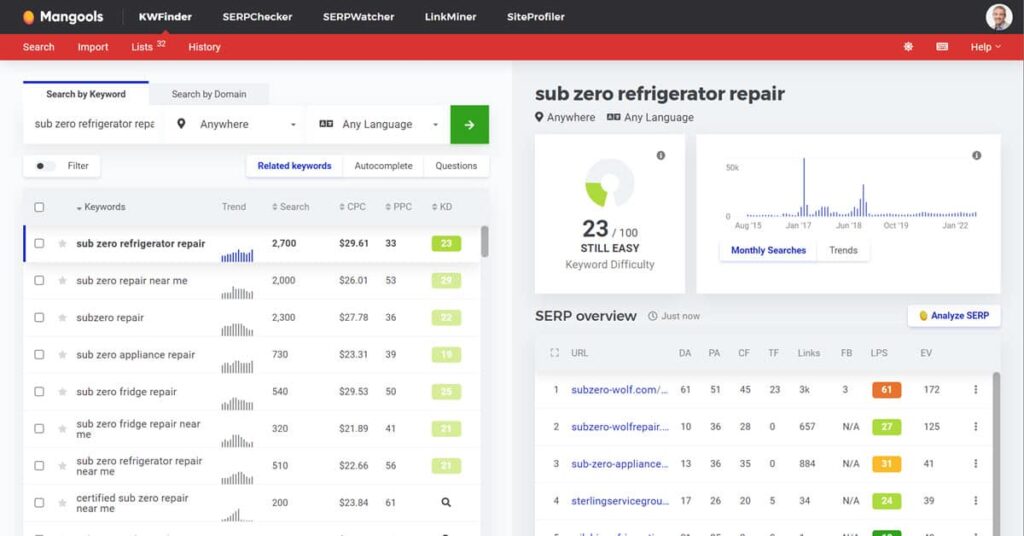

If you advertise your services online, your website, social media profiles, and other marketing assets can be part of the sale. In addition, factors like positive online reviews and good search engine rankings for important keywords can also add value. Both are a key part of an essential online marketing strategy that adds value and will appeal to a new potential business owner who may be looking to acquire your business.

You’ll also transfer leases and utility accounts to the new owner. The sale might include your liability insurance policy, the domain name for your official website, or the lease for the building you use.

Lastly, if you offer appliance service contracts to your customers, you can include these agreements in the sale.

Debts

Did you know small businesses have an average of $195,000 in debt?

If you operate a sole proprietorship, you’re personally responsible for debts unless the creditor agrees to release you. You should plan on settling any debts before the sale or using a portion of the proceeds to pay off business loans and credit lines.

If your business is an LLC, the new owner will take over existing debts unless you sign a personal guarantee. Therefore, a business with a high level of debt will be worth less.

Employees and Competition

Whether they’re working on an old appliance or a new appliance, repairs have no secrets for your key employees. There is tremendous value in an appliance repair technician who is able to easily repair not only kitchen appliances like a refrigerator or an oven, but or other household appliances like a washing machine or dryer. The more skilled they are at performing regular maintenance and repairs on major brands, the better.

Customer satisfaction is essential before, during, and after the sales process is a must. Employees who have excellent rapport and communicate easily and effectively with customers on a service call are essential. These employees can provide you with a steady stream of positive reviews that can help you stand out from the competition – this can raise the value of your business to a prospective buyer.

Taking steps to ensure your employees will stay on with your appliance repair company after the sale can increase the value of your business. For example, a common practice is to offer a stay bonus to encourage employees to stick with the new owner. Offering to pay these bonuses can justify a higher sale price.

You can also add value by signing a non-compete agreement or staying on as an advisor to help the new owner for a few months.

Customers, Market, and Future Growth

Buyers will look at the growth potential when making an offer. The size of your market, your existing customer base, and your growth potential can affect the value of your business.

Factors like limited competition in your service area or excellent customer loyalty scores can result in a higher sale price.

If possible, present data that shows how the local population is increasing or how more people are buying homes and starting families. These trends can help predict an increased demand for appliance repairs.

Historical data from your business can also support the valuation. Show how your sales have increased over the past few years and highlight the strategies you use to achieve sustainable growth, such as educating customers about maintenance, selling service packages, and branching out to fix a wider range of appliances or working with commercial customers.

Taxes

Taxation doesn’t directly affect the sale price, but it significantly impacts how much you get from the sale.

You’ll have to pay a long-term capital gains tax on the proceeds of the sale. You can calculate this amount by deducting your original investment in the business from the sale price.

This amount represents your capital gains. You’ll have to pay a 20% federal tax as well as a state tax if applicable.